Currently, both GM and Toyota are hoping to release PHEVs by 2010. While Ford’s current plan is to release PHEVs sometime between 2012 and 2020. However, Ford’s senior energy storage manager was recently quoted saying, ``If there's going to be a true plug-in hybrid market, we're going to be there. It's just that that's a huge commitment to actually go to production.'' Which indicates to me that for the time being Ford will be sitting on the side-line. Coincidentally, Ford’s June sales decreased by 28%, mostly due to their lack of fuel-efficient cars and trucks relative to some of their peers.

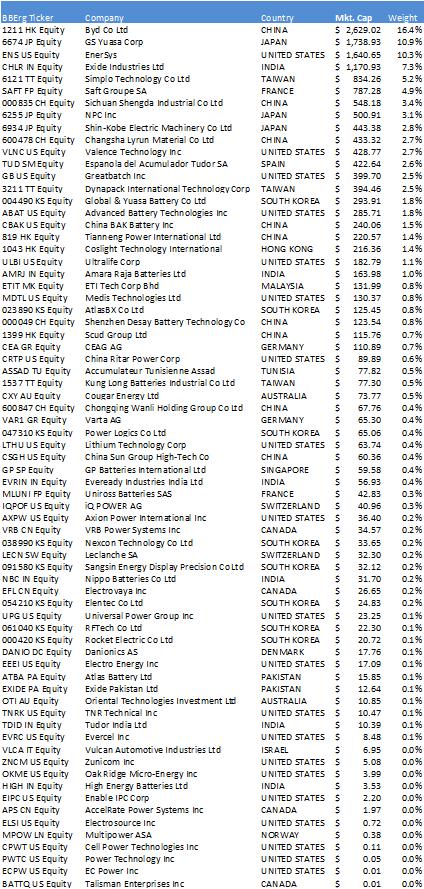

The proliferation of hybrids & PHEVs would place large demands on the battery industry, which could provide investors with good investment opportunities within the sector. However, I personally know very little about the players in the global battery industry, so I decided to give myself a quick primer. According to Bberg’s industry classification system, globally the batteries & battery systems sector has 105 members. With this in mind, I decided to create a global market-cap weighted index to track the overall performance of the sector. Out of the 105 companies my index ended up containing 71 members, I factored out companies with bad data and Energizer. I factored out Energizer because of their large market cap, and since as far as I know they are not developing any automotive related battery products. The average market cap of the index totaled USD225.38mn, with BYD co Ltd of China (1211 HK Equity) having the highest market cap of USD2.6bn (16.4% of index). See the chart below for more details.

I now wanted to compare the performance of the index against the S&P500 and WTI prices. To do this I used daily prices and rebased all the prices to 100 on 8/2/2007 (see charts below):

Source: Bberg

The Global Battery Index has a Positive Correlation with WTI Prices

As you can see from the charts above the global battery index easily out-performed the S&P500 and shows a strong positive correlation to WTI prices. This implies that if energy prices continue to rise or remain elevated we could continue to see the battery outperform the S&P500 as battery related demand increases.

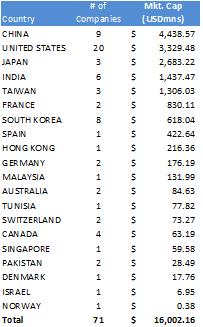

Once this was complete, I geographically broke out the companies. 20 of the 71 companies in the index are located within the US, followed by China with 9, South Korea with 8, and India with 6 (see chart below for more details):

As you can see from the chart above China, the US, Japan, India, and Taiwan together make-up roughly 83% of the total market cap, while containing 58% of the total companies. To further assist this analysis I created country specific indices to compare against the benchmark; at first I found the results surprising.

American Battery Index

Japanese Battery Index

Relative to the overall battery index it is clear that Japan was a significant out-performer. This I believe can partially be explained by the fact that Japan imports nearly 100% of its oil, which among other factors, has led the government to announce oil and gas suppliers will be required to increase the use of renewable energy resources. The government's pro-active approach coupled by the fact that Japanese automakers, such as Honda and Toyota, seem to be on the forefront of hybrid technology should continue to bolster Japanese demand for battery related products. The three Japanese companies included in the index are GS Yuasa Corp, NPC Inc, & Shin-Kobe Electric Machinery Co. Mitsubishi Motors setup a joint venture with GS Yuasa corporation in Dec. 2007 to provide lithium-ion batteries starting in April 2009. According to Bberg, Shin-Kobe was recently rated a buy from Nomura Holdings Inc. who cited an increasing demand for batteries.

Will the other countries within the index follow suit? I beleive so, but further analysis would be needed to isolate specific equities best positioned to take advantage of the potential increase in demand, and I am not in the habit of recommending specific equities on this blog. The bottom line is, as long as oil prices remain elevated we should continue to see increased demand for battery related products as automakers begin moving towards more hybrid and PHEV technology.

1 comment:

Speaking about the Fiat hybrids, the technology double clutch with electric motor between has been stolen by a patent that Fiat Company has never wanted to purchase, but only shamelessly to copy. I invite to visit my blog where her "vitality" of the Fiat planners it appears in all of evidence:

http://dualsymbioticelectromechanicalengine.blogspot.com/

Whoever appreciates an honest industrial ethics in defence of intellectual ownership should spread out the history reported in my blog. If the industries can afford unpunished to copy the ideas and defending it need very expensive legal action, to which target need the patents? How our young people can find intellectual courage if the economic potentates crush the rights of the single ones?

whoever has a good idea on as I could act for defending my rights I beg him to leave a comment in my blog. Thanks and good time to everybody.

Ulisse Di Bartolomei

Post a Comment