I apologize for the recent lack of posts as I got rather caught up with travel and other activities during the holiday season. To start off the year I decided we need to look back before we can look forward. Since the onset of the current crisis we have witnessed what seems like a never ending barrage of unprecedented market conditions and government actions from across the globe. This compiled timeline is meant to act as reference for both the readers and myself, helping us fully comprehend the crisis that has been the past 2 years. So let us begin… (I apologize for the length, but I was hoping to make it as comprehensive as possible using multiple sources) This will be a work in progress and I will likely make numerous additions and deletions over the next several days as I gain access to more sources.

1H 2007:

02/08/07: HSBC announces it is setting aside 20% more than analysts estimated for loan losses in 2006 due to the companies deteriorating US mortgage business. The company announced that home loans to riskier borrowers were going bad faster than estimates. Concurrent with the announcement an index tracking swaps on sub-prime dropped sharply, indicating a significant increase in implied risk. (S&P500: -0.1% TED Spread: 0.3)

02/22/07: Two HSBC top mortgage executives announce departure from US business. (S&P500: -0.1% TED Spread: 0.3)

03/04/07: HSBC confirms they will write off USD11bn to cover mounting losses in its US based HSBC Finance Corporation. (S&P500: -1.1% TED Spread: 0.4)

03/05/07: New Century Financial Co. leads massive drop in US subprime lenders. (S&P500: -0.9% TED Spread: 0.4)

03/12/07: DR Horton CEO announces to investors his company’s fortunes are likely to ‘suck’ in 2007. During the same day trading is suspended on New Century Financial shares as fears rise firm is headed toward bankruptcy. (S&P500: 0.3% TED Spread: 0.4)

03/21/07: Mortgage delinquencies and defaults continue to rise and short sellers reap large rewards for their positions in the US subprime lenders. (S&P500: 1.7% TED Spread: 0.4)

04/02/07: New Century Financial officially files for Chapter 11 bankruptcy; immediately cuts 3,200 jobs. (S&P500: 0.3% TED Spread: 0.4)

04/05/07: Subprime mortgage lender Novastar announces they will stop funding independent mortgage bankers. (S&P500: 0.3% TED Spread: 0.4)

05/30/07: UK mortgage lender Kensington agrees to USD561mn takeover by Investec, a South African Bank. The subprime lender also announces revenues for the current year will be significantly below the previous years. (S&P500: 0.8% TED Spread: 0.7)

2H 2007:

06/23/07: Bear Stearns pledges USD3.2bn to rescue one of its internal hedge funds after it placed bad bets on subprime mortgages. (S&P500: -1.3% TED Spread: 0.8)

07/30/07: IKB cuts profit forecast and replaces its CEO after feeling the effects of the US subprime rout. Additionally, according to Bberg more than 40 companies globally have reorganized or abandoned borrowing plans over the past month. (S&P500: 1.0% TED Spread: 0.5)

07/31/07: American Home Mortgage announces it does not have the cash flow to fund new loans, shares plunge 90%. Bberg reported that creditors made ‘very significant margin calls’ against the company over the past 3 weeks and it still has ‘substantial unpaid margin calls pending’. (S&P500: -1.3% TED Spread: 0.5)

08/02/07: Accredited Home Lenders announces merger with Lone Star Funds may be in doubt and bankruptcy is a distinct possibility. (S&P500: 0.4% TED Spread: 0.6)

08/06/07: American Home Mortgage files for bankruptcy after laying off 7,000 employees. One reason cited is repeated interest rate increases pushing up loan repayments and borrower defaults. (S&P500: 2.4% TED Spread: 0.6)

08/08/07: German WestLB Mellon suspended redemptions from its asset-backed security fund amid concerns over the US subprime mortgage market. The company was quoted as saying current market conditions were making it impossible to calculate the fair net asset value of the fund. (S&P500: 1.4% TED Spread: 0.6)

08/09/07: BNP Paribas halts redemptions from three investment funds due to complications over calculating fair net asset value due to the mortgage markets effects on credit markets. (S&P500: -3.0% TED Spread: 0.8)

08/14/07: Goldman Sachs in conjunction with a group of investors announce a USD3bn injection into the bank’s Global Equity Opportunities Fund, after losing 30% of its value in 1 week. (S&P500: -31.8% TED Spread: 1.0)

08/15/07: Countrywide falls 13% on fears of bankruptcy if conditions continue to deteriorate. (S&P500: -1.4% TED Spread: 1.4)

08/17/07: FOMC approved changes to the primary credit discount window facility reducing the spread between the fed funds target to 50bps. The Fed also announced it would allow term financing for up to 30 days. Finally, in the statement the Fed recognized that ‘downside risks to growth have increased appreciably’, and that they were prepared to take action. Nevertheless, there was no change in the target rate. (S&P500: 2.5% TED Spread: 1.9)

08/21/07: It is reported that German SachsenLB holds USD4bn in US subprime assets. (S&P500: 0.1% TED Spread: 2.0)

08/22/07: H&R Block unable to tap US commercial paper markets due to market turmoil is forced to borrow USD200mn from its credit line. Also, Lehman Brothers becomes the first Wall Street firm to shut down its subprime lending unit, laying off 1,200 employees. Other mortgagee companies announced layoffs totaling 3,700. (S&P500: 1.2% TED Spread: 1.9)

08/23/07: BoA, Citi, & DB borrow USD2bn from the Fed via the discount window to help reduce the ‘last resort’ stigma associated with this lending facility. (S&P500: -0.1% TED Spread: 1.7)

08/29/07: Australian firm Basis Yield files for bankruptcy over subprime defaults. (S&P500: 2.2% TED Spread:1.7)

09/06/07: Inter-bank lending rates continues to soar; the ECB lends USD57bn to banks in a move to help counter the ongoing global credit squeeze. (S&P500: 0.4% TED Spread: 1.5)

09/14/07: Northern Rock receives emergency funding from the Bank of England after rising borrowing costs left the company unable to make new loans. (S&P500: 0.0% TED Spread: 1.7)

09/17/07: Fears of a Northern Rock and/or other financial institution failures cause the government to guarantee Northern Rock deposits to avoid a potential bank run. The same day Novastar, US subprime home lender, forfeits its REIT status as it decides not to pay a dividend on 2006 profit in an effort to conserve cash. (S&P500: -0.5% TED Spread: 1.5)

09/18/07: Stocks rally as Fed announces 50bp rate cut moving the target rate to 4.75%. (S&P500: 2.9% TED Spread: 1.7)

10/05/07: Merrill Lynch announces it will be forced to write down a USD5.5bn loss associated with defaulted US sub-prime mortgages. Analysts are concerned ML’s losses may continue to mount. (S&P500: 1.0% TED Spread: 1.4)

10/24/07: Merrill Lynch announces largest loss quarterly loss in its 93 year history after taking USD8.4bn in write downs. Rating agencies reduce ML’s rating and described the quarterly loss as ‘startling’. (S&P500: -0.2% TED Spread: 1.3)

10/31/07: FOMC decreases fed funds target by 25bps to 4.25%. (S&P500: 1.2% TED Spread: 1.1)

11/08/07: Morgan Stanley reveals a USD3.7bn loss from its US sub-prime mortgage exposure. The bank attributes the loss to the record level of defaults by subprime borrowers. (S&P500: -0.1% TED Spread: 1.6)

11/27/07: Citigroup announces it is selling a USD7.5bn stake to Abu Dhabi to bolster its depleted capital base due to recent acquisitions and credit market turmoil. (S&P500: 1.5% TED Spread: 2.0)

12/10/07: UBS writes off USD10bn in debt linked to subprime mortgage market. The company also reported that losses would total more than the previous year’s profits. Additionally, UBS announced it received USD9.7bn in funds from the Singapore Government Investment Corporation. MBIA, the world’s largest bond insurer announces it will raise as much as USD1bn by selling a stake to a private equity to avoid losing its AAA credit rating. Finally, Bank of America announced it will liquidate a USD12bn cash fund due to turmoil in credit markets. These type of funds attempt to return a higher yield vs. traditional money market funds via positions in riskier assets. (S&P500: 0.8% TED Spread: 2.2)

12/11/07: The Fed reduces target rate 25bps to 4.25%. However, markets reacted adversely interpreting the action and the statement as too weak considering current market conditions. (S&P500: -2.5% TED Spread:2.2)

12/13/07: Due to fears of what effects a elevated inter-bank lending rates could have on the global economy the Fed in conjunction with the central banks of Canada, England, Switzerland, and the EU announced’ measures designed to address elevated pressures in short-term funding markets.’ This announcement setup the temporary Term Auction Facility (TAF) designed to ‘auction term funds to depository institutions against the wide variety of collateral that can be used to secure loans at the discount window’. (S&P500: 0.1% TED Spread: 2.2)

12/14/07: Citi announces it will take over seven troubled Special Investment Vehicles (SIVs) and assume USD58bn in debt to avoid forced assets sales. On the news Moody’s lowered Citi’s credit rating to Aa3 from Aa2, and warned of further potential downgrades. As an interesting aside, Citi invented SIVs in 1988. (S&P500: -1.4% TED Spread: 2.2)

12/17/07: Fed auctions USD20bn to major banks in an attempt to alleviate the global credit crunch as banks remain hesitant to lend based on market uncertainty. (S&P500: -1.5% TED Spread: 1.9)

12/18/07: In response to the Fed the ECB allocates USD500bn to banks at below market rates in a refinancing move to ease tightened credit markets and lower LIBOR. (S&P500: 0.6% TED Spread: 1.9)

12/19/07: As default risks rise, Standard & Poor’s reduces the rating outlooks for many bond insurance companies including MBIA, XL Capital Assurance, and Ambac Financial. According to Bberg industry-wide downgrades would lead to losses of USD200bn on securities as banks would be forced to sell bonds due to investment guidelines. (S&P500: -0.1% TED Spread: 2.1)

12/24/07: Merrill Lynch after experiencing the largest loss in the company’s history receives a USD6.2bn cash injection from Singapore’s Temasek Holdings. At this point in the crisis sovereign wealth funds have already invested over USD25bn in Wall Street banks. (S&P500: -0.8% TED Spread: 1.6)

1H 2008

01/11/08: Bank of America purchases faltering US home lender Countrywide Financial for USD4bn in an all stock deal. (S&P500: -1.4% TED Spread: 1.2)

01/15/08: Citi announces USD18.1bn in write-downs related to its subprime mortgage exposure. Concurrently, in a move to shore up its capital base Citi announces it will cut its dividend. The same day, Merrill Lynch reported it sold a USD6.6bn stake to foreign investors including the Korean and Kuwaiti governments. (S&P500: -2.5% TED Spread: 0.9)

01/22/08: As global financial conditions continue to deteriorate the Fed announces a rare inter-meeting rate cut of 75bps to 3.50%, this was the largest cut in 25 years. (S&P500: -1.1% TED Spread: 1.4)

01/30/08: The Fed cuts rates by an additional 50bps to 3.00% in an attempt to help avoid a US recession. Statement reads; "Financial markets remain under considerable stress, and credit has tightened further for some businesses and households." (S&P500: -0.5% TED Spread: 1.1)

02/14/08: UBS confirms loss for 2007 as exposure to US housing market hits earnings. The firm warned of poor performance and USD18.4bn in write downs weeks earlier. The firm also revealed an additional USD26.6bn in exposure to risky mortgages. UBS’s losses were far worse than analysts’ estimates. (S&P500: -1.3% TED Spread: 0.8)

03/03/08: HSBC announces a USD17.2bn loss derived from the effect of the decline in the US housing market on its loan values. However, annual profits still rose 10%. (S&P500: 0.1% TED Spread: 1.3)

03/06/08: A large hedge fund run by Peloton Partners collapses as it can no longer make interest payments on loans made to the company to buy assets, forcing the fund to sell assets at substantial losses. (S&P500: -2.2% TED Spread: 1.6)

03/07/08: Ambac raises roughly USD1.5bn in a sale of convertible stock to maintain AAA credit rating. Some analysts report this will only work as a short-term fix. (S&P500: -0.8% TED Spread: 1.5)

03/08/08: The Fed announces two new initiatives to address growing liquidity pressures in the term funding markets. These include increases in the amounts outstanding to the TAF to USD100bn, and a series of term repurchase transactions totaling an additional USD100bn. (S&P500: -0.8% TED Spread: 1.5)

03/11/08: The Fed issues a statement that G10 central banks continue to work closely together on liquidity issues, but pressures have continued to rise. Further coordinated actions between the Fed, Bank of Canada, Bank of England, ECB, and Swiss National Bank were also announced, which included expansion of its securities lending program and the introduction of a Term Securities Lending Facility (TSLF). Also, Carlyle Fund, a mortgage-debt investment fund, asked lenders to halt further liquidation of collateral worth roughly USD16bn. (S&P500:3.7% TED Spread: 1.4)

03/14/08: JPMorgan and the Fed bailout Bear Stearns ending the banks 85 year run; the Fed released a statement declaring, ‘The Board voted unanimously to approve the arrangement announced by JPMorgan Chase and Bear Stearns this morning.’ (S&P500: -2.1% TED Spread: 1.6)

03/16/08: The Fed announces two new initiatives intended to bolster market liquidity and stabilize volatile market conditions. The first created a lending facility to assist primary dealers to provide financing to the securitization markets. The second was to reduce the primary credit rate to 3.25% from 3.50%. Finally, they approved increasing the maximum maturity of primary credit loans to 90 days from 30, and approved the financing agreement for JP Morgan to purchase Bear Stearns. (S&P500: -2.1% TED Spread: 1.6)

03/18/08: The Fed announces an additional 75bp cut in the fed funds target moving the rate to 2.25% as the market continue to deteriorate and the probability of a US recession rises. (S&P500: 4.2% TED Spread: 1.6)

03/25/08: JPMorgan increases original USD2/share Bear Stearns offer to guarantee quick deal after pressure from shareholders. (S&P500: -0.2% TED Spread: 1.4)

03/31/08: Treasury Secretary Henry Paulson proposes the largest overhaul of US financial regulations since the Great Depression, saying the system for overseeing American capitalism needs to be better prepared for ‘inevitable market disruptions.’ (S&P500: 0.6% TED Spread: 1.3)

04/01/08: UBS announces additional write downs of USD19bn related to the US housing market. At the same time Deutsche Bank discloses write downs totaling USD4bn on US real estate loans and assets. Total write downs by banks at this point now equal roughly USD200bn. (S&P500: 3.6% TED Spread: 1.3)

04/04/08: Fitch downgrades MBIA to AA from AAA stating the bond insurer no longer has enough capital to warrant the top ranking. Fitch reported MBIA would have needed as much as USD3.8bn more in capital to deserve an AAA. (S&P500: 0.1% TED Spread: 1.4)

04/08/08: Washington Mutual raises USD7bn from an investment group led by private equity group TPG after failing to shore up finances. The nation’s largest savings and loans bank had been adversely affected by rising delinquencies and mortgage defaults. The company’s efforts to shore up financing via cutting dividends and a USD3bn stock sale fell short forcing WAMU to seek external financing. (S&P500: -0.5% TED Spread: 1.3)

04/14/08: Wachovia, considered to be a relatively conservative player in the banking world, announces a USD393mn quarterly loss and a 41% dividend cut. (S&P500: -0.3% TED Spread: 1.6)

04/18/08: Citigroup reports a better than estimated loss of USD5.11bn for Q1, rallying 4.5% for the day. At this point Citi’s write-downs and credit losses total almost USD40bn. (S&P500: 1.8% TED Spread: 1.6)

04/21/08: A group of mutual and hedge funds led by Corsair Capital invest USD7bn to recapitalize National City Bank, 10th largest in the US, after losing USD333mn in 4Q07. (S&P500: -0.2% TED Spread: 1.6)

04/22/08: As banks continue trying to raise capital, Merrill Lynch receives USD9.6bn via bond and preferred share sales after writing down USD6.5bn in assets. Concurrently, RBS announces additional losses of USD11.7bn related to the US subprime market and will attempt to raise USD24bn in new capital to shore up reserves. (S&P500: -0.9% TED Spread: 1.7)

04/29/08: Citi announces it will sell USD3bn of stock to improve capital reserves. Analysts were upset with this move as they were hoping Citi could avoid an equity sale as it will dilute shareholder equity. Also on this day HBOS, the UK’s largest mortgage lender, announced it will sell USD8bn in shares to bolster capital depleted by asset write downs and a deteriorating housing market. (S&P500: -0.4% TED Spread: 1.4)

04/30/08: The Fed again reduces the fed funds target this time by 25bps to 2.00%. Concurrently, Citi sells USD4.5bn worth of stock vs. the USD3bn originally planned. The company is raising capital to avoid further credit-rating downgrades, maintain client relationships, and preserve access to financing. Analysts estimate Citi would need to raise USD 10-15bn to truly sure up its capital reserves. (S&P500: -0.4% TED Spread: 1.4)

05/02/08: The Fed, ECB and Swiss National Bank announce expansions to the ongoing liquidity measures, including increases to the TAF, and expansion of accepted collateral for the Term Securities Lending Facility (TSLF). (S&P500: 0.3% TED Spread: 1.3)

05/06/08: Fannie Mae receives permission from regulators to expand activities in light of failing mortgage market, and plans to raise USD6bn in capital and cut its dividend to USD0.25 from USD0.35. Regulators also reduced the company’s surplus capital requirement to 15% from 20% to expand business. (S&P500: 0.8% TED Spread: 1.2)

05/07/08: Vallejo CA plans to file for bankruptcy as the decline in the housing market cuts into the town’s tax revenues. (S&P500: -1.8% TED Spread: 1.1)

05/09/08: Citi CEO Vikram Pandit announces plans to ‘wind down’ roughly USD400bn in assets over the next three years to help return the bank to profitability. According to Robert Olstein, CIO of Olstein Capital, ‘He's carting off the non-significant operations and raising money so that he can reinvest it in the business he's in, which is loaning money.’ (S&P500: -0.7% TED Spread: 1.0)

05/13/08: Federal Reserve Chairman Bernanke sends letter to Congress requesting expedited approval to pay interest on reserves deposited by commercial banks to help alleviate tension in the credit market. (S&P500: 0.0% TED Spread: 0.9)

05/19/08: Regulatory filings show that banks and securities firms are keeping USD35bn of markdowns off income statements. At this point total write downs total about USD344bn. (S&P500: 0.1% TED Spread: 0.9)

05/26/08: UBS announces ‘the bank’s losses on non-US residential and commercial real-estate securities could increase in the future’. UK home prices dropped for the eighth straight month with no slowdown in sight. (S&P500: -1.3% TED Spread: 0.8)

2H 2008

06/02/08: S&P cuts credit-ratings for Morgan Stanley, Merrill, & Lehman. These downgrades could potentially have adverse business impact via selling derivative products, increased counter-party risk, etc… S&P said, ‘…actions reflect prospects of continued weakness in the investment banking business and the potential for more write-offs, though not of the magnitude of those of the past few quarters.’ Risks of further equity dilution via equity sales to bolster capital reserves remain high. Additionally, shares of Britain’s largest buy-to-let mortgage lender Bradford & Bingley plunge on profit warnings and sale to TPG. (S&P500: -1.1% TED Spread: 0.9)

06/05/08: Despite efforts to maintain credit ratings MBIA and Ambac Financial, the world’s largest bond insurers, are downgraded from AAA to AA by S&P. These companies together insure roughly USD1trn in debt. Moody’s announced they were placing both companies on review for a possible downgrade the day prior. (S&P500: 1.9% TED Spread: 0.9)

06/09/08: Lehman Brothers reports a Q2 loss of USD3bn and will raise USD6bn in stock sale. This was Lehman’s first loss since going public. "I am very disappointed in this quarter's results. Notwithstanding the solid underlying performance of our client franchise, we had our first-ever quarterly loss as a public company," said Chairman and Chief Executive Richard Fuld Jr. "However, with our strengthened balance sheet and the improvement in the financial markets since March, we are well positioned to serve our clients and execute our strategy." (S&P500: 0.1% TED Spread: 0.8)

06/12/08: KeyCorp plunges in trading on its move to raise USD1.5bn through equity sales and plan to cut dividends by 50%, citing unforeseen charges. "The loss, in our view, seems one-time in nature since it stemmed from an unfavorable court ruling. Also, KeyCorp reaffirmed its guidance for charge-offs in 2008 at 100-130 basis points and said that the new capital was only done due to the quarterly loss," DB’s financial analyst Mike Mayo wrote. "Yet, KeyCorp is raising $300-$400 million more than the loss given the environment." (S&P500: 0.3% TED Spread: 0.8)

06/18/08: Fifth Third Bancorp falls in trading after announcing it will cut dividends and raise USD2bn in capital to shore up capital reserves. (S&P500: -1.0% TED Spread: 0.9)

06/25/08: The Fed votes to keep rates unchanged at 2.00%. Also, California sues Countrywide Financial which lost USD2.5bn amid rising defaults and foreclosures over lending practices. (S&P500: 0.6% TED Spread: 1.0)

07/07/08: Freddie Mac & Fannie Mae drop sharply to 13 year lows on concerns over capital. A credit strategist at DB said, ‘There's a lot of apprehension about write downs… If they have write downs, they have to raise capital. How much do they raise and how easily can they do that? Those are the questions that everybody is asking’. Mortgage delinquencies continue growing at a record pace while home prices continue to plummet. (S&P500: -0.8% TED Spread: 1.0)

07/11/08: IndyMac is seized by US regulators after a run by depositors left the mortgage lender short on cash. IndyMac specialized in Alt-A mortgages (no documentation mortgages), which undoubtedly was one of the primary catalysts for its downfall. (S&P500: -1.1% TED Spread: 1.2)

07/13/08: Treasury Secretary Paulson announces a plan to temporarily increase the line of credit available to the GSEs to ensure they have sufficient capital to conduct business and protect the financial system from systemic risk moving forward. The Fed also approved a measure to lend to Fannie and Freddie if necessary. (S&P500: -1.1% TED Spread: 1.2)

07/18/08: A rights offering to shareholders of Barlcays and HBOS receive lukewarm response achieving minimal participation. (S&P500: 0.0% TED Spread: 1.3)

07/25/08: National Australia Bank makes additional provisions of USD830mn for credit crisis exposure. “Although current losses on the assets underlying the CDOs in our portfolio relating to the provision average approximately 2 per cent of the total portfolio, out detailed analysis and recent default activity indicates the portfolio will continue to deteriorate.” (S&P500: 0.4% TED Spread: 1.1)

07/28/08: Merrill writes down an additional USD5.7bn and is forced to sell more equity. Merrill’s CEO John Thain is pushing to rid the firm of its collateralized debt obligations (CDOs), the primary driver behind the firms USD18.7bn loss to date; many of these instruments are linked to subprime mortgages. (S&P500: -1.9% TED Spread: 1.1)

07/30/08: Fed announces additional measures to enhance the effectiveness of its existing liquidity facilities. These measures include longer maturities to the Fed’s Term Auction Facility (TAF) and increases in the level of swaps with the ECB and Swiss National Bank. (S&P500: 1.7% TED Spread: 1.1)

08/05/08: Fed leaves target rate unchanged at 2.00% and indicates a tightening bias in minutes. (S&P500: 2.9% TED Spread: 1.1)

08/20/08: Analysts announce Fannie and Freddie may need to raise as much as USD100bn to cover potential losses from declining mortgage market. Shares drop sharply in trading on the news. Higher implied credit risk and tight credit markets make it increasingly difficult for either organization to raise funds. It has also been revealed secret talks by Lehman Brothers to sell a 50% stake to South Korean or Chinese investors have failed. The reason for the failure is said to be Lehman was asking for too high of a price. (S&P500: 0.6% TED Spread: 1.1)

09/07/08: Government seizes control of Fannie and Freddie by placing both companies into a special conservatorship by the Federal Housing Finance Agency & US Treasury. The Treasury will be able to purchase USD100bn of a special class of stock in each company to maintain a positive net worth, and also be able to provide short-term funding. (S&P500: 0.4% TED Spread: 1.2)

09/15/08: The effects of US housing crisis force Lehman Brothers to file for nation’s largest bankruptcy after being unable to find a suitor. Almost simultaneously, Bank of America announced they would acquire Merrill Lynch. Additionally, fears of an AIG failure continue to mount. Despite the Fed announcing several measures to enhance existing liquidity measures, due immeasurable uncertainties testing the market in face of the this news the market experienced a significant decline for the day. (S&P500: -4.7% TED Spread: 1.8)

09/16/08: The market still reeling from yesterday’s news learns that in order to prevent the imminent failure of AIG the Fed will lend the company USD85bn and receive a 79.9% equity stake. In an attempt to calm the market Treasury Secretary Paulson is quoted saying, ‘We are working closely with the Federal Reserve, the SEC and other regulators to enhance the stability and orderliness of our financial markets and minimize the disruption to our economy,’ At the same time, despite expectations the Fed keeps rates unchanged at 2.00%. (S&P500: 1.8% TED Spread: 2.0)

09/17/08: The US Treasury at the request of the Fed introduces a supplementary financing program to provide cash for use by the Federal Reserve. (S&P500: -4.7% TED Spread: 3.0)

09/18/08: At 3:00pm EST the Fed in conjunction with the ECB, Bank of Canada, Bank of England, and Swiss National Bank announce an unprecedented coordinated action to improve liquidity conditions in global financial markets. The Fed authorized an additional USD180bn expansion of current swap lines to provide USD funding. At this point it seems clear the Fed preferred to manage credit vs. conducting monetary policy to deal with the current crisis. Markets reverse declines over the course of the day. (S&P500: 4.3% TED Spread: 3.0)

09/19/08: Congress and Treasury officials reveal negotiations are underway to establish a rescue akin to the Resolution Trust Corporation (RTC) setup to liquidate the assets of failed savings and loan associations (S&Ls) in the early 90s. The idea would be for the government to relieve financial markets of toxic debt adversely impacting market conditions. The fed also announces two further enhancements to its liquidity program 1) extending non-recourse loans at primary credit rate to US depository institutions and bank holding companies in order to purchase high-quality asset backed commercial paper from money market funds, & 2) to purchase agency discount notes from primary dealers. (S&P500: 4.0% TED Spread: 2.2)

09/21/08: Goldman Sachs and Morgan Stanley place requests and are reclassified as bank holding companies from investment banks. The Fed provides both banks with liquidity to smooth the transition against any collateral ‘that may be pledged at the Federal Reserve's primary credit facility for depository institutions or at the existing Primary Dealer Credit Facility (PDCF).’ The G7 finance ministers via a statement to reaffirm their strong and shared commitment to international financial stability. (S&P500: x% TED Spread: x)

09/24/08: Additional swap lines are setup between the Fed, the Reserve Bank of Australia, Denmark’s National Bank, Norges Bank, and Sverriges Riksbank to alleviate pressure in the USD short term funding market. (S&P500: -0.2% TED Spread: 3.0)

09/25/08: Washington Mutual fails after concerns cause customers to withdraw USD16.7bn of deposits since September; this is the largest bank failure in US history. Remaining assets were sold to JP Morgan Chase. (S&P500: 2.0% TED Spread: 3.0)

09/26/08: The Fed along with the Bank of England, ECB, and Swiss National Bank again agree to increase swap lines to further alleviate funding pressure. (S&P500: 0.3% TED Spread: 2.9)

09/29/08: UK mortgage lender Bradford & Bingley and Iceland’s Glitnir bank are nationalized, Fortis NV is bailed out by the Belgium, Netherlands, and Luxembourg governments, and finally the Fed, ECB, Bank of England, and Bank of Japan inject more liquidity into the system via special term financing and TAF increases. The FDIC also announces that Citi will acquire the banking operations of Wachovia, ‘in a transaction facilitated by the Federal Deposit Insurance Corporation and concurred with by the Board of Governors of the Federal Reserve and the Secretary of the Treasury in consultation with the President.’ Finally, the Bush administrations financial rescue plan was rejected by Congress leading to a 777 point drop in the Down Jones Average. (S&P500: --8.8% TED Spread: 2.9)

09/30/08: In order to prevent further bank failures the Irish, Belgium, Luxembourg, and French monetary authorities move to action. The Irish authorities guarantee deposits at major banks, while the remainder injects money into Dexia SA to prevent its failure. (S&P500: 5.3% TED Spread: 3.2)

10/01/08: The US Senate approves financial rescue plan, which had been rejected by the House earlier in the week. The House will re-vote on a modified version of the bill October 3rd. (S&P500: -0.3% TED Spread: 3.3)

10/03/08: US House approves modified Emergency Economic Stabilization Act of 2008. Furthermore, in a change of plans Wachovia agrees to a merger with Wells Fargo, walking away from FDIC assisted deal with Citi. It is also announced portions of Fortis bank are being nationalized by Dutch government. (S&P500: -1.4% TED Spread: 3.8)

10/06/08: With new authority granted by the rescue act the Fed announces plans to begin paying interest on depository institutions’ required excess reserve balances, and approve substantial increases in the size of the TAF. Germany’s second largest property lender Hypo Real Estate receives USD68bn rescue package. (S&P500: -3.9% TED Spread: 3.7)

10/07/08: Central banks across the world move to counter the growing financial crisis ranging from additional nationalizations in Iceland to rate cuts in Australia. The Fed unveils its Commercial Paper Funding Facility (CPFF), ‘a tool that will complement the Federal Reserve's existing credit facilities to help provide liquidity to term funding markets’. (S&P500: -5.7% TED Spread: 3.5)

10/08/08: To prevent a collapse in the banking sector the UK Treasury announces the availability of at least USD350bn under a special liquidity scheme to recapitalize the system. Additionally, the US, UK, Canada, Sweden, Switzerland, and the EU conduct a coordinated rate cut of 50bps. Hong Kong and China also cut rates, but by 100bps and 27bps, respectively. Finally, the ongoing short-selling ban expires at midnight and the Fed reduces the minimum fee of the System Market Account securities lending program to 0.10% from 0.50% while also increasing the aggregate limit to USD5bn from USD4bn. (S&P500: -1.1% TED Spread: 3.9)

10/09/08: Fed authorizes NY Federal Reserve Bank to borrow securities from AIG for up to USD37.8bn. (S&P500: -7.6% TED Spread: 4.2)

10/12/08: G7 central bankers and finance ministers release a plan of action which includes injecting capital into banks and guaranteeing interbank loans. Further measures were announced by the Fed, ECB, Bank of England, Bank of Japan, and Swiss National Bank to improve liquidity in the short-term USD funding market. Australia also announces to will guarantee bank deposits for three years to combat global financial crisis. (S&P500: -1.2% TED Spread: 4.6)

10/13/08: RBS, HBOS, and Llyods will receive USD64bn from the British government to improve tier one capital ratios. Germany pledges USD681bn to recapitalize banking sector. (S&P500: 11.6% TED Spread: 4.5)

10/14/08: US Treasury, Fed, and FDIC announce measures to implement the newly approved USD750bn rescue package (TARP), which will guarantee loans, extend insurance to non-interest bearing account, and inject capital into banks. The Fed also increases the magnitude of its swap lines with Japan. (S&P500: -0.5% TED Spread: 4.3)

10/15/08: ECB injects a further USD250bn of liquidity into the market in a continued attempt to reignite credit markets; it also announces they will accept lower rated securities and a wider range of currencies as collateral from banks. Finally, the ECB approved a USD6.7bn loan to the fledgling economy in Hungary. (S&P500: -9.0% TED Spread: 4.3)

10/16/08: The Fed makes two announcements, the more significant of the two now permits bank holding companies to account for its senior perpetual preferred stock issue to the Treasury as Tier 1 capital. The Swiss National Bank injects USD5.3bn into UBS, taking a 9.3% stake in the company, while Credit Suisse is able to raise capital from private investors and the Qatar Monetary Authority. (S&P500: 4.3% TED Spread: 4.1)

10/21/08: The Fed introduces the Money Market Investor Funding Facility (MMIFF). The facility is designed to provide liquidity to US money market investors through providing, ‘senior secured funding to a series of special purpose vehicles to facilitate an industry-supported private-sector initiative to finance the purchase of eligible assets from eligible investors.’ In other news, Bank of Canada reduces its overnight rate by 25bps to 2.25%, and cash injections by European banks continue to be well received by market participants. (S&P500: -3.1% TED Spread: 2.7)

10/22/08: Wachovia reports a 3Q08 loss of USD23.9bn on write-offs and mortgage losses. The Fed alters its formula to calculate interest rate paid to depository institutions on excess balances reducing the spread between the target funds rate and rate paid on excess balances to help propagate trading in the funds market at levels closer to the target. (S&P500: -6.1% TED Spread:2.5)

10/23/08: Reserve Bank of New Zealand and Sveriges Riksbank both cut reference rates 100bps and 50bps, respectively. (S&P500: 1.3% TED Spread: 2.6)

10/27/08: Japanese authorities indicate they would be willing to intervene to bring down the price of the yen after it experience sharp appreciation as investors continued to unwind the carry trade. (S&P500: -3.2% TED Spread: 2.7)

10/28/08: In a response to the decline in the AUD Australian government officials intervene in the market for the third consecutive day to prop up the currency. Declining commodity prices and a weaker economic outlook are the primary drives behind the currency’s recent weakness. The Fed also announces a new swap line with the Reserve Bank of New Zealand for US15bn. Finally, the IMF, World Bank, and ECB agree to lend a combined USD25.1bn to the Hungary in a bid to restore confidence. (S&P500: 10.8% TED Spread: 2.7)

10/29/08: The Fed once again cuts the target rate by 50bps to 1.00%; statement highlighted moderation in inflation and risks to growth. The Fed also announced new swap lines for up to USD30bn with Banco Central do Brasil, Banco de Mexico, Bank of Korea, and the Monetary Authority of Singapore. (S&P500: -1.1% TED Spread: 2.8)

10/31/08: The Bank of Japan cuts its reference rate by 20bps to 0.30%. (S&P500: 1.5% TED Spread: 2.6)

11/03/08: Recent data releases point to continue tightening in US loans market for both commercial and residential uses. US auto sales reach lows not experienced since the early 80s. (S&P500: -0.3% TED Spread: 2.4)

11/04/08: The Reserve Bank of Australia cuts rates by 75bps to 5.25%. (S&P500: 4.1% TED Spread: 2.2)

11/05/08: The Fed again changes formula use dot determine the interest rate on required and excess reserve balances. Rate will now equal the lowest FOMC target rate in effect during the reserve maintenance period. (S&P500: -5.3% TED Spread: 2.1)

11/06/08: Both the Bank of England an ECB cut reference rates by 150bps to 3.00% and 50bps to 3.25%, respectively. Wells Fargo sells USD11bn in stock to help fund purchase of Wachovia, and states it may sell an additional 61mn shares. (S&P500: -5.0% TED Spread: 2.1)

11/10/08: Fed approves application of American Express to become a bank holding company; at which point Amex requests funds via the emergency rescue package. (S&P500: -1.3% TED Spread: 1.9)

11/12/08: Secretary Paulson announces the TARP will be used primarily to inject capital into banks and extend loan guarantees to credit cards, auto loans, and student loans. (S&P500: -5.2% TED Spread: 2.0)

11/19/08: Citi announces it will purchase the remaining USD17.4bn in assets held by its structured investment vehicles (SIVs), market responds adversely shares plunge 23% in trading. (S&P500: -6.1% TED Spread: 2.1)

11/20/08: Swiss National Bank cuts its target range for 3-month LIBOR by 100bps to 0.5%-1.5%. Ailing auto lender GMAC submits application to become bank holding company in order to gain access to TARP funds. ‘As a bank holding company, GMAC would obtain increased flexibility and stability to fulfill its core mission of providing automotive and mortgage financing to consumers and businesses,” the company said in a statement. “GMAC also expects to have expanded opportunities for funding and for access to capital as a bank holding company.’ (S&P500: -6.7% TED Spread: 2.1)

11/23/08: Citigroup receives a bailout from the US government which includes guarantees, liquidity access and injection of USD20bn in capital. The government receives USD27bn in preferred shares, or roughly a 4.5% stake in the company. (S&P500: 6.3% TED Spread: 2.1)

11/25/08: The Fed introduces the Term Asset-Backed Securities Loan Facility (TALF) designed to assist the credit needs of households and small businesses via issuing asset-backed securities collateralized by student loans, auto loans, credit card loans, and loans guaranteed by the SBA. Another program was initiated to purchase obligations of the housing-related GSEs and MBS back by Fannie, Freddie, and Ginnie. Additionally, US mortgage lender Downey Financial files for Chapter 7 bankruptcy. (S&P500: 0.7% TED Spread: 2.1)

11/26/08: People’s Bank of China lowers one-year lending and deposit rate by 108bps, and reduces reserve requirements by 200bps. Meanwhile, Iceland’s Glitnir Bank files for Chapter 15 bankruptcy in the US. (S&P500: 3.5% TED Spread: 2.1)

11/28/08: A failed stock offering by RBS forces the UK government to become a majority stakeholder with a 58% stake in the company. (S&P500: 1.0% TED Spread: 2.2)

12/01/08: NBER officially recognize US recession, place start date as December 2007. (S&P500: -8.9% TED Spread: 2.2)

12/02/08: Fed announces that the PDCF, AMLF and TSLF will be extended through April 2009. US auto sales continue to plummet. The Reserve Bank of Australia cuts rates by a further 100bps to 4.25%. (S&P500: 4.0% TED Spread: 2.2)

12/03/08: The Reserve Bank of New Zealand follows suit and cuts rates by 150bps to 5.00% as economic conditions deteriorate. (S&P500: 2.6% TED Spread: 2.2)

12/04/08: ECB cuts rates by 75bps to 3.25%. Bank of England cuts rate 100bps to 2.00%. Sweden’s Riksbank cuts rates 100bps to 2.00%. (S&P500: -2.9% TED Spread: 2.2)

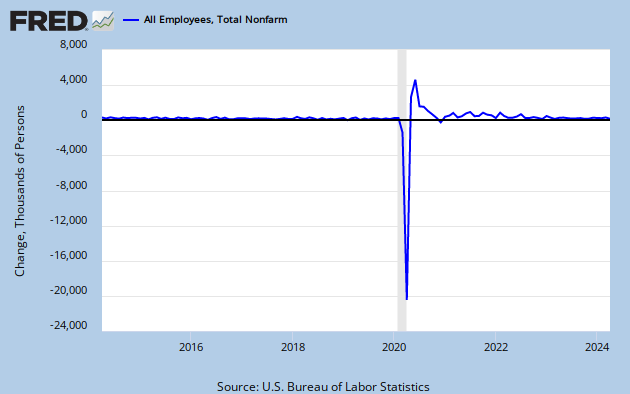

12/05/08: US non-farm payrolls see biggest decline (-533k) since 1974. (S&P500: 3.6% TED Spread: 2.2)

12/08/08: US government irons out deal with US automakers to provide bridge financing through 1Q09. Deal entails some government oversight and requirement to construct a plan of action for the reorganization of the industry. Deal still requires Congressional approval. (S&P500: 3.8% TED Spread: 2.2)

12/09/08: Bank of Canada reduces rates by 75bps to 1.50%. Yield on 4-wk US T-Bill reaches 0%. (S&P500: -2.3% TED Spread: 2.1)

12/11/08: US Senate fails to approve bridge loan to automakers which was previously approved by House to guarantee funding for the remainder of the year. (S&P500: -2.9% TED Spread: 2.0)

12/15/08: AIG sells USD39.3bn in assets to NY Fed. The move was designed to help rid AIG of its obligations on mortgage debt. (S&P500: -1.3% TED Spread: 1.8)

12/16/08: The Fed once again takes an unprecedented action moving the fed funds target rate to a range of 0%-0.25% from 1.00%. The statement said, "The Federal Reserve will employ all available tools to promote the resumption of sustainable economic growth and to preserve price stability," and "The focus of the Committee's policy going forward will be to support the functioning of financial markets and stimulate the economy through open market operations and other measures that sustain the size of the Federal Reserve's balance sheet at a high level." This action represents a shift from traditional monetary policy to quantitative easing. (S&P500: 5.1% TED Spread: 1.8)

12/18/08: Citi’s credit rating is lowered by Moodys to A2 from Aa3 reflecting, ‘weakened earnings prospects, in combination with an average quarterly preferred dividend of approximately $1.4 billion’ according to Moodys. (S&P500: -2.1% TED Spread: 1.5)

12/19/08: The Fed modifies the TALF program extending the term of loans from 1 year to 3 years and adds additional specifications of eligible ABS collateral. Loans will also now be available to all eligible investors rather than being distributed through an auction. The bank of Japan also reduced its uncollateralized overnight target by 20bps to 0.10%. Bush administration and US Treasury officials work out a deal with US automakers to use TARP funds to keep companies afloat through March 2009. (S&P500: 0.3% TED Spread: 1.5)

12/20/08: Latvia receives USD10.4bn loan from the IMF and EU to strengthen the country’s economy and banking system. (S&P500: x% TED Spread: x)

12/22/08: People’s Bank of China cuts rate for the 5th time. (S&P500: -1.8% TED Spread: 1.5)

12/23/08: AMEX, now a bank holding company, receives USD3.39bn from TARP to ensure the company’s survival. (S&P500: -1.0% TED Spread: 1.4)

12/24/08: The Fed approves GMAC’s request to become a bank holding company permitting it to access TARP funds. (S&P500: 0.6% TED Spread: 1.5)

12/29/08: GMAC receives USD5bn equity investment through TARP funds, while GM obtains USD1bn in assistance to purchase equity in GMAC. (S&P500: -0.4% TED Spread: 1.4)

12/30/08: The Fed announces it will start TALF operations in January to purchase mortgage-backed securities backed by Fannie, Freddie, and Ginnie. In addition, now government controlled Indymac Bancorp is set to be sold to a group of private investors. (S&P500: 2.4% TED Spread: 1.4)

1H 2009

01/05/09: Fed begins purchasing fixed rate MBS backed by Fannie, Freddie, and Ginnie via TALF. (S&P500: -0.5% TED Spread: 1.3)

01/07/09: The Fed adopts two changes to the MMIFF 1) expansion of the institutions eligible to participate & 2) adjustments to several parameters including minimum yield on assets, "to enable the program to remain a viable source of backup liquidity for money market investors even at very low levels of money market interest rates." (S&P500: -3.0% TED Spread: 1.3)

01/08/09: The Bank of England cuts rates by 50bps to 1.50% citing declines in confidence and tight credit markets. (S&P500: 0.3% TED Spread: 1.3)

01/13/09: Citi sells Smith Barney to Morgan Stanley in a bid to raise cash, in turn ending its ‘financial supermarket’ legacy. (S&P500: 0.2% TED Spread: 1.0)

01/15/09: Citi announces it will be split into two units to separate its core business from its troubled assets. It is also announced BoA will receive an additional USD20bn to guarantee against loan losses. Ireland is forced nationalize third largest bank, Anglo Irish, as funding position receded. JPMorgan announces profits fell 76% due to rising defaults and the ongoing US recession. (S&P500: 0.1% TED Spread: 1.0)

01/19/09: UK introduces further bailouts for the financial sector including increasing stake in RBS in return for an increment in lending. (S&P500: 0.8% TED Spread: x)

01/20/2009: The Bank of Canada cuts rates by 50bps to 1.00% citing a deteriorating outlook for the global economy. S&P downgrades Spain from AAA quoting structural weakness in the Spanish economy. (S&P500: -5.3% TED Spread: x)