A credit default swap is an agreement between two parties, in which one party pays a premium to the other party, who in return provides protection against the default of an underlying bond. A CDS can be written or bought by anyone, even if they do not own the underlying bond. Since the price of the CDS is the amount a buyer is willing to pay for protection against a potential default it goes without saying that the price is a good measurement of market implied risk. This also means there should be some correlation between sovereign ratings and the sovereign CDS prices.

To start, let’s take a look at the three major rating agencies rating systems. The chart below breaks out each of the major rating companies systems, with the green area representing investment grade ratings and the red area representing non-investment grade ratings. I have also included the credit ratings of the Asian countries for each of the 3 agencies (see below).

Moodys, S&P, & Fitch Credit Ratings

Asian Countries Credit Rating

Next, I created a composite rating system for the countries being analyzed. To do this I assigned number values to the above rating system with the highest rating for each agency equaling 1, and the lowest rating equaling 21. In the case an agency had a positive outlook for any given country I subtracted 0.5 from their score (i.e. a S&P rating of AA would equal 3, but an AA rating with a positive outlook would equal 2.5). I then averaged these results together for each country and created the consolidated rating (see chart below).

You can see from the chart above that for each country, except Vietnam, current CDS prices correspond well to each countries composite credit rating. The next step is to look at each countries CDS performance to determine shifts in implied market risk, especially given the current credit crisis and large equity sell-offs.

Hong Kong - China 5yr CDS Spread

Source: Bberg

Over the past couple of months CDS prices in Hong Kong and China have seen a significant rise, this corresponds to the recent equity sell-off in both countries. Japanese CDS prices also rose, but remained somewhat contained compared to Hong Kong and China. It is important to highlight that year to date the Nikkei 225 is down 14.86% verse 23.70% & 46.5% for the Hang Seng and Shanghai indices, respectively. Recently, we have witnessed significant volatility between the Hong Kong and Chinese 5yr CDS spread; nevertheless the spread has begun to revert back to its historical average of around 12bps.

Similar performance can be seen for 5yr CDS in the Korean, Malaysian, and Thai markets. Generally speaking we have seen the spreads between Thailand, Malaysia and Korea moving tighter during the recent volatility.

Historical 5yr CDS Philippines, Indonesia, & Vietnam

Finally, and possibly most interesting we have seen 5y CDS move significantly higher in Vietnam. This comes despite the fact that over the past several years the spread between 5yr Vietnamese CDS and that of Indonesia and the Philippines has remained relatively constant. I believe the reason for this is due to growing concern over Vietnam’s economy and a growing conflict between the government plan to maintain economic growth and the central bank’s goal of controlling growing pricing pressures.

Charts:

Source: Bberg

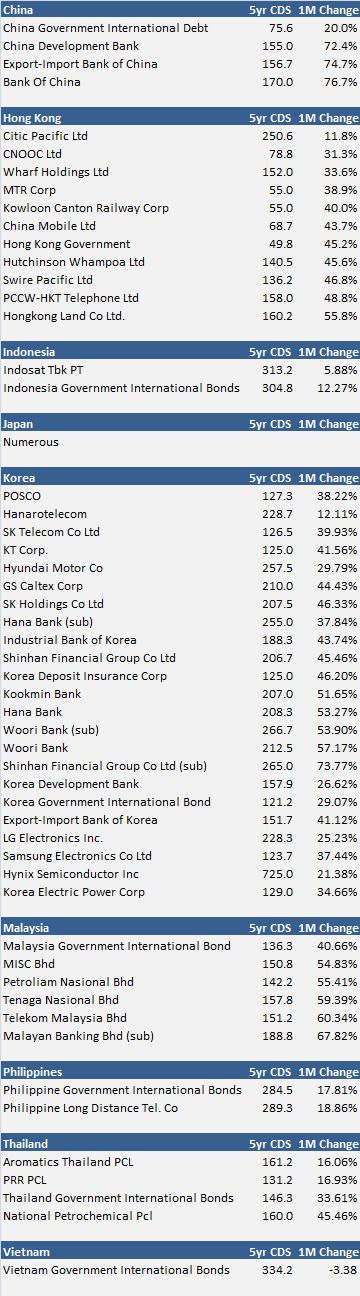

List of CDS traded in Asia

Source: Bberg (pricing from 7/7/08)

2 comments:

Wow! that was an amazing analysis.

Could you elaborate on the relationship of cds spreads and the performance of the underlying bond (price) esp. for Philippines? Do they have a relationship? If so, how fast does a change in bond prices affect the cds spreads? Thanks.

Hi Tom - nice post. Would you mind elaborating more on the relationship between sources of funds and uses of funds for a given country? How could i obtain a more clear clarification of what sources of funds pay off debt coming due - and where reserves are located (just CB reserves?)

Would tax revenues and borrowings be the only sources of funds? I am trying to build a sovereign credit model to forecast sources/uses

Post a Comment