Looking back to last week, as we expected the market was unable to maintain the upward momentum it experienced the week prior. This was due to weaker than expected data from the consumer sector and financial related news. The Dow and S&P500 ended the week down 1.17% and 1.08%, respectively, and we could have more bad news this week.

There is a significant chance we could see the probability of a 50bp cut rise this week after the ISM and employment data are released

Source: Cleveland Fed

Source: Cleveland Fed

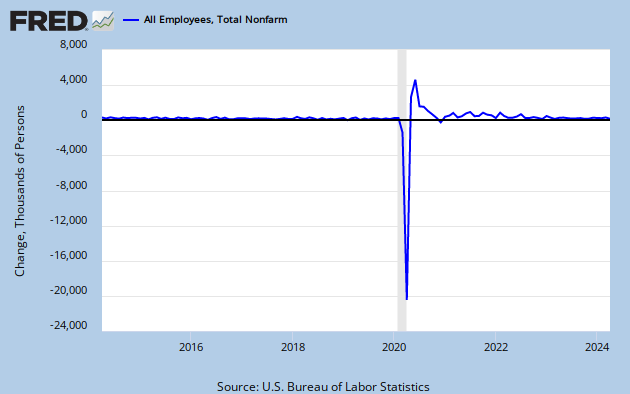

This week has its fair share of important data releases; underscored by Tuesday’s ISM release and Friday’s pivotal employment report. We believe both of these indicators have considerable downside risks as the economy moves further into a recession. Here’s why, the charts below show the performance of the ISM and the change in nonfarm payrolls over the last 50 years (recessions highlighted in gray). As you can see from the charts, we haven’t begun to touch the lows for these indicators during a recession. In fact, over the past 50 years the ISM has averaged 42.6, while the change in payrolls has averaged -154K during recessions. To make matters worse, in nearly every case the ISM moved sub-40, while in every case the net change in payrolls broke -300K. As these indicators continue to deteriorate, it will become more apparent, that this crisis isn’t solely contained in the financial economy. However, we believe the Fed’s response up to this point has been the correct one for a slowdown in the real economy. This should help curtail long-term sustained losses in these indicators when compared to past recessions. Nevertheless, things will get worse before they get better.

ISM performance over the past 50 years (recessions highlighted in gray)

Source: BBerg

Change in nonfarm payrolls over the past 50 years (recessions highlighted in gray)

Source: BBerg

Source: BBerg

Let’s take a look at the some of the important indicators coming out this week in the US :

Monday March 31st:

9:45AM: NAPM-Chicago (Risk: Downside)- According to the consensus survey the market is expecting a reading of 46.0, compared to 44.5 the previous month. We believe the NAPM will continue to deteriorate as the economy moves into a recession.

TBD: Annual Crop Planting Report- The Department of Agriculture’s annual crop planting report is something I have never really looked at in much detail. However, this year investors are using it as an indicator towards the commodity. The report is considered a bellwether for farming in the year ahead. In any case, this report will likely have an impact in the commodities market, so keep an eye out. This report outline’s farmers intentions to plan crops; the USDA will release actual numbers in June.

Tuesday April 1st:

10:00AM: ISM Manufacturing Index (Risk: Downside)- The BBerg consensus survey is anticipating a release of 48.0 versus 48.3 the previous month. As we outlined in the text above we believe there are considerable downside risks to this indicator, given it has averaged 42.6 during recessions over the last 50 years.

10:00AM: Construction Spending (Risk: Neutral)- The consensus survey is anticipating a change of -1.1% m/m vs. -1.7% m/m last month. What will be important to look at in this release is the change in non-residential construction. Non-residential construction has remained resilient during the current crisis, but it has begun to falter. Last month private non-residential construction spending moved negative for the first time during this crisis, and we believe this may be the start of a trend.

Wednesday April 2nd:

8:15AM: ADP Employment Report (Risk: Downside/Neutral)- This release will be used to help gauge the change in Friday’s employment report.

10:00AM: Factory Orders (Risk: Neutral)- The consensus survey is anticipating a release of -0.6% m/m compared to -2.5% the month prior. Factory orders should continue to slow-down as the economy cools down.

Thursday April 3rd:

8:30AM: Jobless Claims (Risk: Neutral)- According to the consensus survey the market is expecting weekly jobless claims of 366K. This number should remain within recession territory (+350K), which does not bode well for the overall employment situation.

10:00AM: ISM Non-Manufacturing Index (Risk: Neutral)- The consensus survey is anticipating a reading of 49.0 compared to 50.8 the month prior.

Friday April 4th: Employment Day!

8:30AM: Employment Report (Risk: Downside)- The BBerg consensus survey is expecting a 50K decline in non-farm payrolls and an unemployment rate of 5.0%. We believe there is significant downside risk for both of these indicators, and believe it is possible we could see a large spike in both (as we outlined in the text above).